The most Accurate AVM.

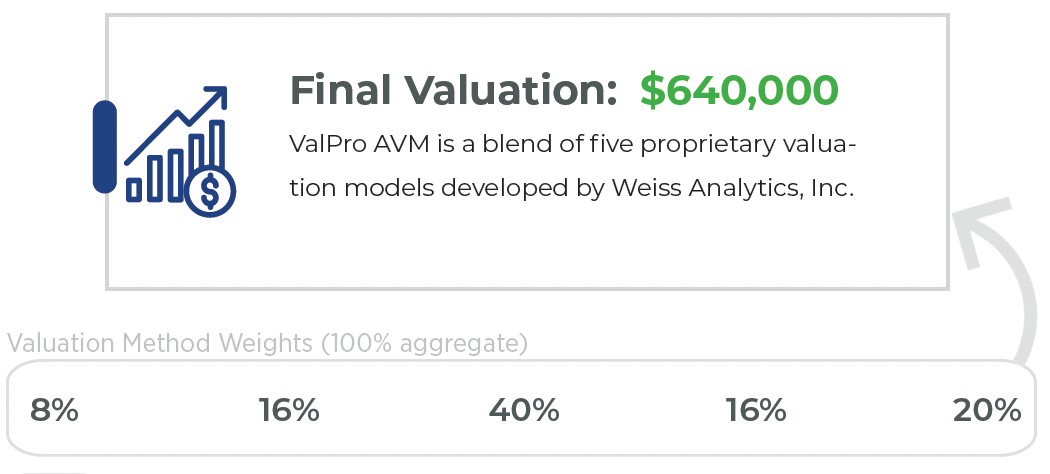

The best AVMs in the world use 1 or 2 models, We use FIVE models to make the most accurate AVM we have ever built.

Allan Weiss – Creator of the S&P/Case Shiller Home Price Index

2:48 duration

Trusted by clients worldwide

Our AVMs are Third Party Tested & Certified.

ValPro is one of the Nationally Top Ranked AVMs for accuracy in US Residential Real Estate. Let us show you how we’re better.

AI driven solutions for exceptional outcomes

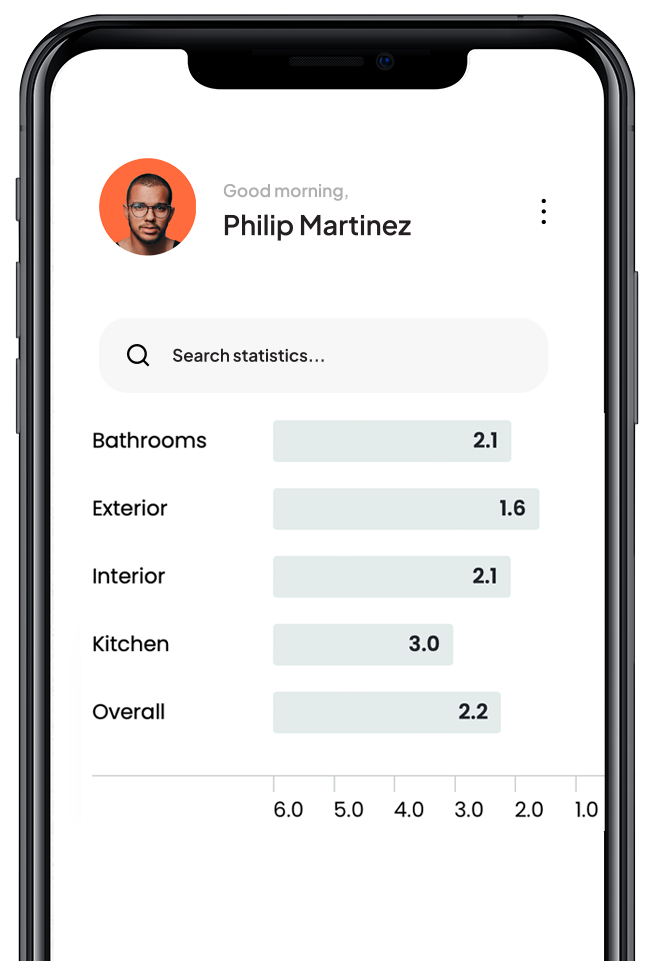

- AI-Powered Condition & Quality assessment strategies using 100’s of simultaneous models

- Damage & Deferred Maintenance detection and scoring

- Deterministic Quality Assessment from basic contractor grade to luxury finishes

- Scoring Output Compliance with Fannie Mae Uniform Appraisal Dataset

Reduce risk with our house level risk metrics

- Highly Accurate Valuations that consider physical condition.

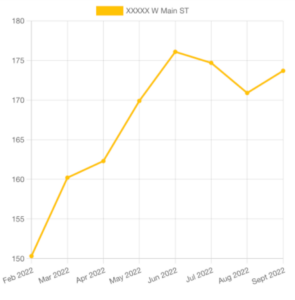

- Price forecasts movements for the next 24 months.

- Early bubble detection

Weiss Analytics products are built upon our House Specific Price Indexes, the most accurate time adjustments ever built.

ValPro AVM

- Top Nationally Ranked AVM

- Third-Party Tested & Certified

- Property Characteristics

- Hedonic Valuation

- Hyper Local Comps

- House Level Forecast

- Exportable PDF Report

- Available by API

Automated Vision Valuation (AVV)

- ValPro AVM INCLUDED

- Upload Photos OR Videos

- Advanced AI Photo Analysis

- Automatic Room Identification

- Automatic Damage Detection

- Quality & Condition Scores

- Available by API

Appraisal Workbench

- ValPro + AVV INCLUDED

- User Selectable OR Automatic Comps

- Market Heat Map

- Transparent Interactive User Adjustments

- Distance to Waterfront

- Distance to Busy Roads

- Available by API

Featured On